Recently while working on a self-imposed assignment – testing the application of blue ocean strategy on an actual business situation – I came across a series of recent blog posts by Sami Dob at Ericsson. I was delighted to see an industry practitioner write about the blue-ocean-strategy. While it has insightful recommendations, it did challenge some of my understanding of the concept.

These blog entries refer to the application of Blue Ocean Strategy to the Networked Society – defined as a combination of heterogeneous networks, connected by end-point devices and served by the cloud ecosystem.

So? Why this blog entry?

For one, I wonder if the ‘Networked Society’ is the right ‘unit of analysis’ when applying this framework here? Secondly, there are couple of smaller observations I had about the application in this particular example. And lastly, it raised typical questions about organizational challenges.

What’s this about strategy and ocean?

Blue Ocean Strategy – as per my understanding – is a business model innovation framework; it enables a firm to ‘create an uncontested market space’, gaining a first-movers advantage, maintaining a lead and keeping competition at bay (apparently as competition is nullified).

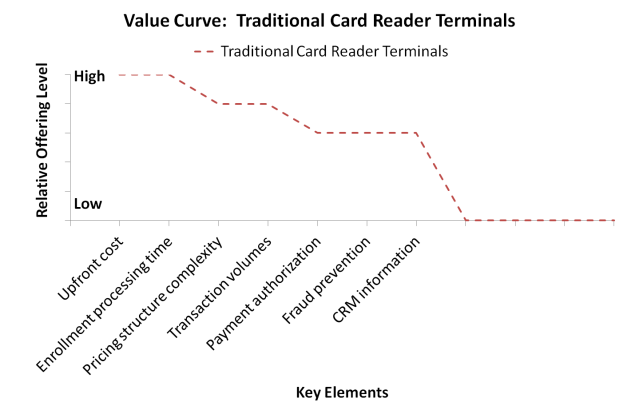

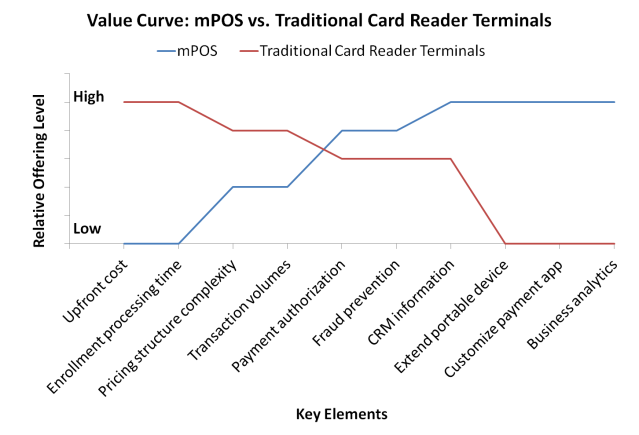

A part of this – the four-action framework ERRC (Eliminate, Reduce, Raise, Create) – is instrumental in leveraging the ‘value curve’ to create the ‘new offering’. Changes to factors of competition can be driven by a motivation to improve the value for the buyer and/or reduce costs for the provider. The focus on these attributes can thus be eliminated, reduced or raised. Attributes in Create (C) are best when borrowed from the ‘closest-substitute’ industry (there are statistical ways to figure this out), adapting only the relevant, low-cost, high-value attributes relevant to the offering. For instance, in the (often mentioned) case of Cirque du Soleil the substitute was among those that ‘Entertained’! Theatre’s could be considered the closest match – and pulling in some attributes from here enabled creating a new offering as we know it today.

Back to the dilemma

Coming back to my initial conundrum I am still struggling with the question of substitution in this particular case? What can possibly substitute an aggregation like the Networked Society? Hence, I still wonder if it is the right ‘unit of analysis’?

Then,the value-curve (a.k.a the strategy canvas) for the red-ocean of the networked society, suggests that the offering level score of ‘Price’ for current buyer is way too low. I would argue however, that end-consumers today benefit from low prices thanks to the intensity of competition among telecom operators. This makes me conclude that the offering level score on this canvas for the red-ocean should be on the higher side. (Either that, or my understanding of the Y-axis’s representation is skewed)

Secondly, in the second part of the blog, Mr. Dob suggests that regulators “should remove national roaming charges in order to stimulate voice traffic”. If that were the case, wouldn’t it give all the players the same level of advantage – competitive parity to all! How is it going to benefit a single operator? The notion of achieving a sustainable competitive advantage would fall apart here.

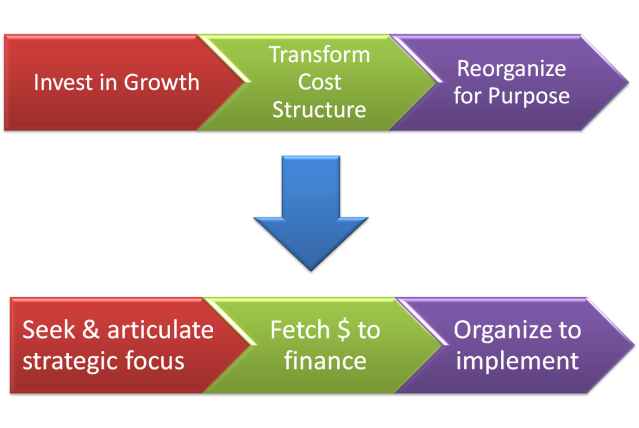

The organizational challenges when applying Blue Ocean Strategy in a leading industry incumbent player are two fold:

1. Cannibalization: The new service offering strategy would have a different value curve to the existing one, impeding continuation and growth of the existing portfolio. This surely impacts the culture in an organization and hence needs a careful change management practice.

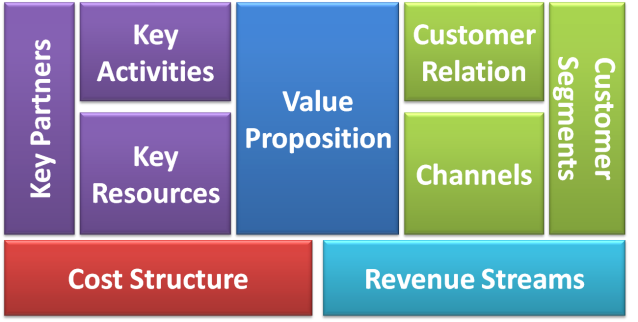

2. Managing multiple business-models – This is a derivative of the previous. An organization can decide to stick with multiple business models for the longer term, or decide to transition from one to another. This can be tricky to manage as outlined by Osterwalder & Pigneur

The articles have driven me to put some more thought to this framework, encouraging me revisit the literature! Hopefully I shall have some more clarity in the days to come.