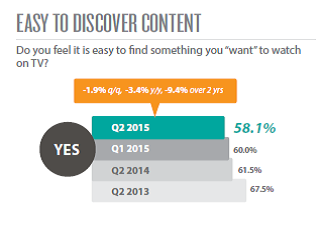

Following up on the previous one. Having laid out the content value chain, I pointed to the demand side indication that – availability of content has made discovery a problem worth solving. A quick glance at each of them below.

Content Creation

Premium content makers like Disney and Discovery Communications have taken a leap towards Direct to Consumer (D2C) initiatives. Disney launched DisneyLife in UK for £9.99 per month in Q4 2015, planning to expand in rest of Europe in 2016. Discovery Communication announced launch of its premium OTT service in Denmark, Sweden & Italy. For studios, the primary source of revenue is licensing. The portal page for an app like Disney’s D2C offering focuses on Disney characters (instead of movie titles) like top selling franchises a.k.a Frozen.  Recommendation will help user stickiness, but the target audience here doesn’t care much about discovery. The incentive to reduce churn on a subscription service via recommendations isn’t strong enough (yet).

Recommendation will help user stickiness, but the target audience here doesn’t care much about discovery. The incentive to reduce churn on a subscription service via recommendations isn’t strong enough (yet).

Subscription VOD (SVoD) players like Netflix and Amazon are investing in creating their own original content. Revenues are driven by ‘subscription’ (needless to say). SVoD players can benefit consumers by offering a recommendation solution, helping them make a choice from a diverse catalogue. A far more powerful tool for these players is analytics, to ensure they remain ahead of the curve in monitoring consumer preferences which has a strong bearing on investments in original content. A good recommendation system will drive user experience and user stickiness (an indirect $ impact) for an SVoD player. Improved content discovery will quicken the feedback loop. However from a consumer perspective – he will get all these niceties in the wall-garden of these individual services. An SVoD player will be far from being able to leverage all the hooks in the user journey of content consumption.

The other extreme of the spectrum has independent artists and freelancers, creating niche content for targeted audience. They work either with multi-channel networks (MCNs) to reach a large viewer base or themselves manage their creation on the usual suspects – YouTube, VEVO and others. These are typically ad-supported models. With little resources of their own, independent artists rely on the content aggregators to improve the discovery experience.

Content Aggregation & Distribution

In this seemingly infinite pool of content, next in line are content aggregators & distributors. (Telco) Operators & PayTV providers have their own managed networks (read ‘walled gardens’) distributing content (in the form of channels) to consumers through varied media (satellite/cable/ter restrial). Bundled subscriptions have been the norm till date – putting together a mix of highly desirable and nice-to-have channels together. The likes to Sling TV however have started to disrupt this arena – leading to ‘skinny’ bundles. Triple/Quad/’you-name-it’ Play from the telcos – mixing the phone, the internet and PayTV package together – are yet another way to earn revenues and reduce churn. Certain operators also benefit from government subsidies/grants and government imposed license fees to fund these operations. From the Operators & PayTV providers kitchen, till date the (Electronic) Program Guide (EPG) has been the recipe to help users make choices. PayTV providers have also started playing with non-linear sources and the EPG fails the litmus test here. A good recommendation system will drive user stickiness for the operator reducing churn.

restrial). Bundled subscriptions have been the norm till date – putting together a mix of highly desirable and nice-to-have channels together. The likes to Sling TV however have started to disrupt this arena – leading to ‘skinny’ bundles. Triple/Quad/’you-name-it’ Play from the telcos – mixing the phone, the internet and PayTV package together – are yet another way to earn revenues and reduce churn. Certain operators also benefit from government subsidies/grants and government imposed license fees to fund these operations. From the Operators & PayTV providers kitchen, till date the (Electronic) Program Guide (EPG) has been the recipe to help users make choices. PayTV providers have also started playing with non-linear sources and the EPG fails the litmus test here. A good recommendation system will drive user stickiness for the operator reducing churn.

OTT providers are the other open-internet based content distributors. Transaction VoD (TVoD) players (like Maxdome, Videoland in Europe) rely on licensing arrangements with content owners and earn their revenues through a transactional (pay per view) model. TVoD players strongly benefit from a search & recommendations solution, giving users an improved discovery solution, thereby directly influencing revenues. However the TVoD service will compete for viewer’s attention against SVoD services, cable subscription and other content sources.

Content Consumption

And lastly – the point of consumption – a massive television in the living room or a compact handheld device. It could also one of many media streaming devices connected to TVs (the Chromecast, Roku, Apple TVs, Fire TV and others) that give users access to the world of content. Device makers primarily make money through one time device sales. Transitioning from a product-only business model to product/service oriented business model, device makers now aim for a share of revenues from content service partner subscriptions acquired through their devices. For a media-streaming device maker, a similar rationale applies like that for TVoD players.

A good recommendation system, means increased user engagement, which in turns equals higher traffic on non-linear content through the device in the hope of new subscriptions originating from it. All of this would mean increased ancillary revenues on top of device sales.

For this consumer though, his linear-TV consumption habit does not get captured when recommending a movie or program from his catalogue on the media-streamer. Likewise TV maker, can have a positive impact on the ancillary revenue, however more importantly the consumer could get an integrated experience. The different kind of sources connected to the TV – USB, set top box, media streamer, dvd player, built in OTT Apps – can give the TV maker that ability to know what kind of content the user watches across these sources.

The final word – All for one, one for all!

OTT services installed on the TV, linear viewing habits from broadcast, on-demand content consumption patterns – all of these could act as inputs to a recommendation system, giving a better understanding of user preferences. Taking a wild-step ahead, if the industry players decide to drop the wall, they could potentially benefit from knowing the user behaviour in the other’s world (OTT players will know what linear TV viewers are watching, and the other way around). Industry players & analysts already start to recognize these barriers. Gaining this insight will help up-stream players streamline their own content portfolio. Industry leaders in this space would perhaps not want to do this approach (after all a Netflix viewer for example, spends effort to find the Netflix icon and browse through its catalogue), however tier 2 & tier 3 players and the challengers in both these content worlds would stand to benefit from this standardized approach, with the possibility of overall increase in user engagement and revenues.